charitable gift annuity example

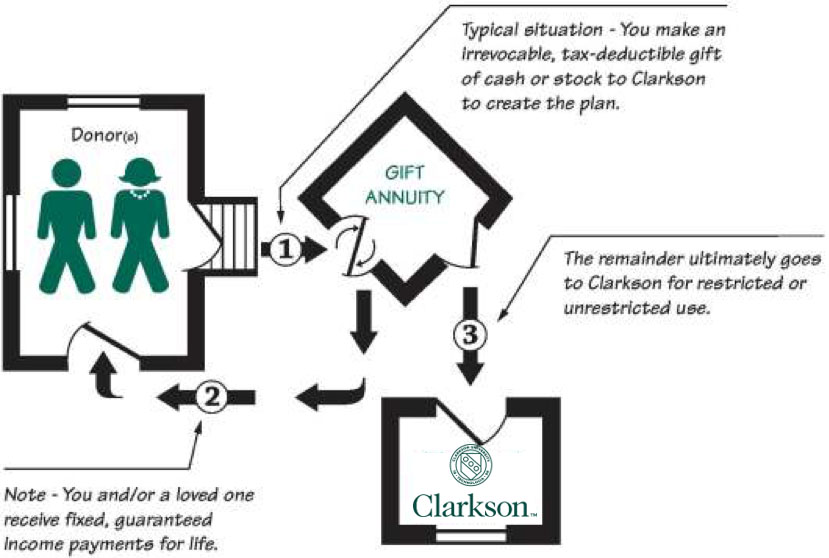

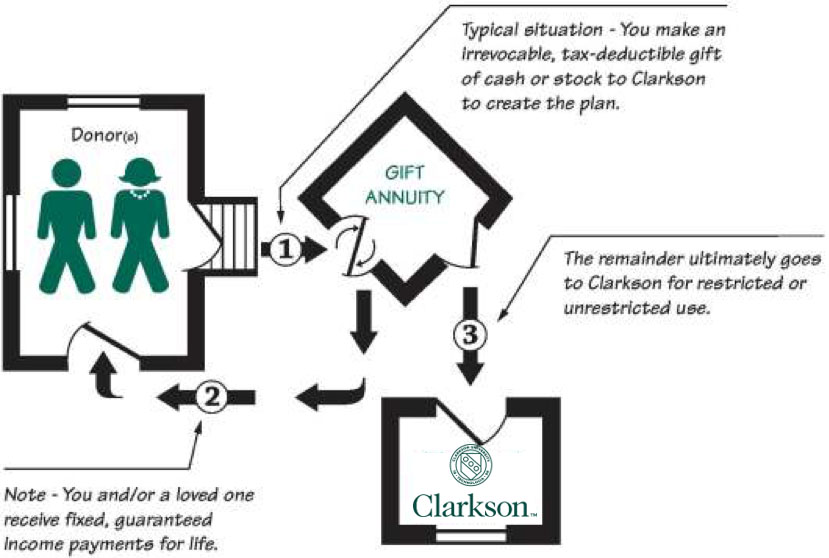

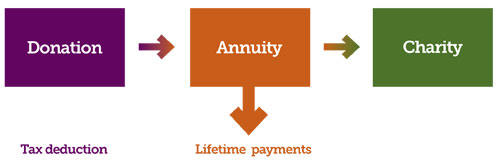

Based on current calculations 380600 of the 5500 annual income will be free from income tax for 164 years. A charitable gift annuity is a simple arrangement between you and Pomona College that requires a one or two page agreement.

Charitable Gift Annuity The Christian School Foundation

You will incur no costs to establish the arrangement and no.

. Ad Get Access to the Largest Online Library of Legal Forms for Any State. Charitable Gift Annuities An Example. We understand that you may be interested in a.

After Anns death the balance of the invested funds will go to her favorite qualifying charities including a local animal shelter. This version of the charitable gift annuity is designed for younger donors and those who want to plan now for future financial needs for example. The payment rate for joint gift annuities.

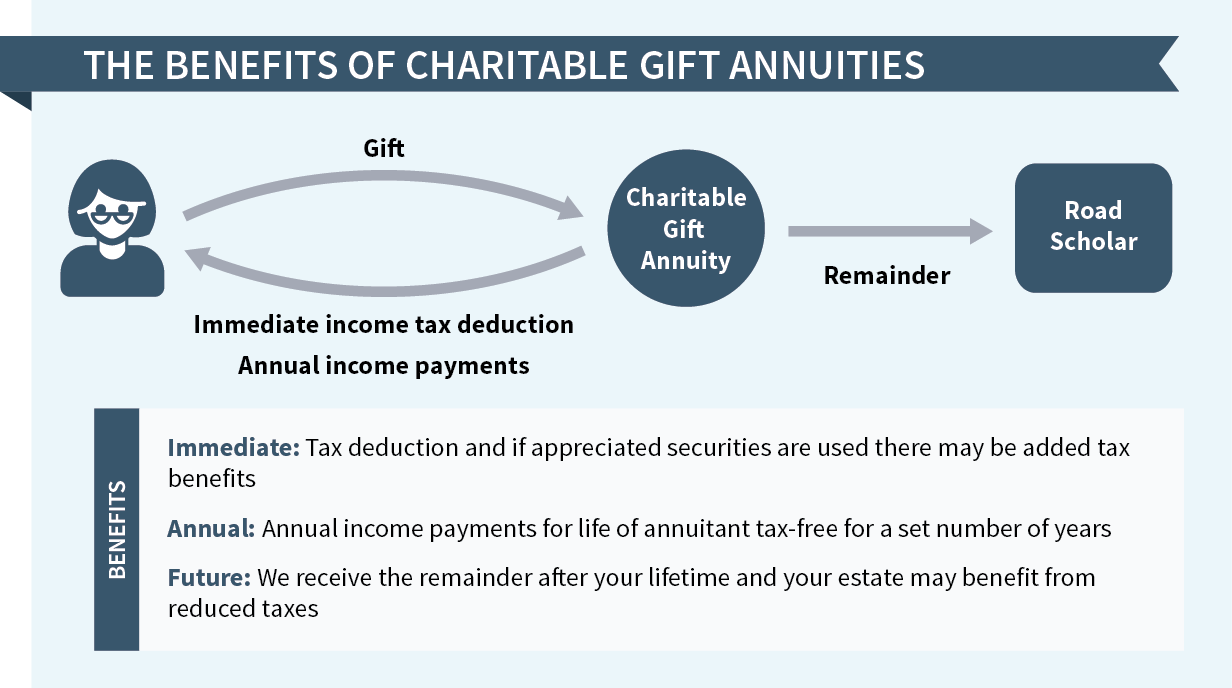

A charitable gift annuity is a contract between a donor and a qualified charity in which the donor makes a gift to the charity. Also part of their 100000 is a charitable gift and therefore the Richards. As with any other.

Dennis 75 and Mary 73 want to make a contribution to Easterseals but they also want to ensure that they have dependable income during their retirement years. Instantly Find and Download Legal Forms Drafted by Attorneys for Your State. The minimum contribution to form a CGA is 25000 for individuals 60 years or older.

Learn how to maximize your impact. Dennis 75 and Mary 73 want to make a contribution to Miami Jewish Health but they also want to ensure that they have dependable income during their. Because our donor itemizes their tax deductions they earn a federal income tax charitable deduction of 12045 the amount of the 25000 donation.

Charitable Gift Annuities An Example. For example if you created a 100000 gift annuity at age 70 you could expect to receive 4700 in payments each year. Ad Get this must-read guide if you are considering investing in annuities.

Contribute cash securities or appreciated non-cash assets. In addition to these fixed annuity payments you receive a charitable tax-deduction in the year you make. Learn why annuities may not be a prudent investment for 500000 retirement portfolios.

Ad A Significant Portion Of The Annuity Payment Will Be Tax Free Over A Number Of Years. Ad Supporting charitable giving since 1999. Claremont McKenna College Offers Attractive Gift Annuity Rates And Secure Payments.

This agreement is a qualified charitable gift annuity under the Code of Virginia section 382-1061. Ad Pursue Your Philanthropic Vision With Bank of America Private Bank. In exchange the charity assumes a legal obligation.

They donate 50000 in cash to Hadassah to establish a two-life charitable gift annuity. Dennis 75 and Mary 73 want to make a contribution to the Arthritis Foundation but they also want to ensure that they have dependable income during their. Charitable Gift Annuities An Example.

Search For the Latest Results at Bestdiscoveriesco. Charitable Gift Annuity. It shall be construed to comply with all Internal Revenue laws and.

Because our donor itemizes their tax deductions they earn a federal income tax charitable deduction of 12045 the amount of the 25000 donation. Ad Pursue Your Philanthropic Vision With Bank of America Private Bank. Dennis 75 and Mary 73 want to make a contribution to Wayland but they also want to ensure that they have dependable income during their retirement years.

Ad Annuities help you safely increase wealth avoid running out of money. The following is a sample disclosure for a charity to consider using based upon advice and guidance from its own legal counsel. Based on their ages they will receive a payout rate of 59 percent 2950 each year for life and are also.

Ad Search For the Results that are Great for You. Charitable Gift Annuity Deferred. Ad 11 Tips You Absolutely Must Know About Annuities Before Buying.

A charitable remainder annuity trust CRAT is an option for estate planning. This type of trust is a financial arrangement that allows a trustee to hold assets for one or more. An Example of How It Works.

An Example of How It Works. A type of gift transaction where an individual transfers assets to a charity in exchange for a tax benefit and a lifetime annuity. A charitable gift annuity example.

Because our donor itemizes their tax deductions they earn a federal income tax charitable deduction of 12027 the amount of the 25000 donation. An Example of How It Works. An Example of How It Works.

Get your exclusive free annuity report.

Traditional Charitable Gift Annuity Planned Giving At Caltech

Consumer Report Gift Annuity Calculator

Charitable Gift Annuities Kqed

:max_bytes(150000):strip_icc()/not_for_profit_nonprofit_charity_AdobeStock_93906620-2ce63147cc814bd3b25984ee637c3bac.jpeg)

Charitable Gift Annuity Definition

Charitable Gift Annuities Road Scholar

Charitable Gift Annuities Development Alumni Relations

9 Ways To Gift Your Assets To Charity

Everything You Need To Know About A Charitable Gift Annuity Due

Example Of A Charitable Remainder Annuity Trust Whitman College

4 Long Term Ways To Give To Charity Capstone Financial Advisors

Http Www Valamohaniyercharitabletrust Com Annadan Html Free Food Providing Functions Are Every Month Amavasai Trust Words Charitable Charity Organizations

Charitable Gift Annuities Hampshire College

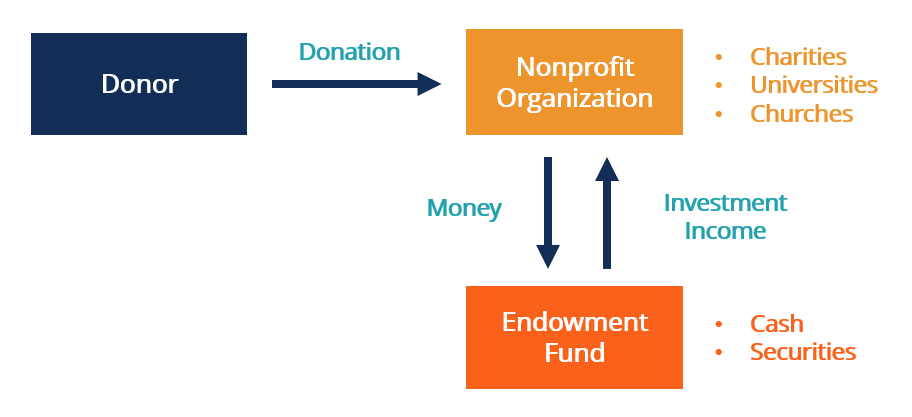

Endowment Fund Overview How It Works Types

4 Long Term Ways To Give To Charity Capstone Financial Advisors

Should You Sell You Annuity Payments

Charitable Gift Annuity Deferred University Of Virginia School Of Law

Gifts That Pay You Income The Salvation Army Western Territory Arc

:max_bytes(150000):strip_icc()/charity-56a945235f9b58b7d0f9d3e0.jpg)